ETFs vs mutual funds has been this nagging thing in the back of my mind for, like, forever now. Seriously, sitting here in my little home office in Chicago—it’s January 3, 2026, snow piling up outside, my space heater humming away—and I’m sipping cold coffee while scrolling through my brokerage app again. I remember back in the day, maybe 2018 or whenever, I threw a chunk of my savings into this mutual fund because the guy at the bank swore it was “diversified and managed by pros.” Ha, pros who charged me an arm and a leg while underperforming the market. Felt like such a sucker.

But yeah, I eventually flipped most of it to ETFs a few years back, and honestly? Best move I made, even if it took me way too long to figure it out. Don’t judge—I’m just a regular dude trying not to screw up my retirement. Anyway, let’s hash this out like I’m venting to you over text.

Why ETFs vs Mutual Funds Even Keeps Me Up Sometimes

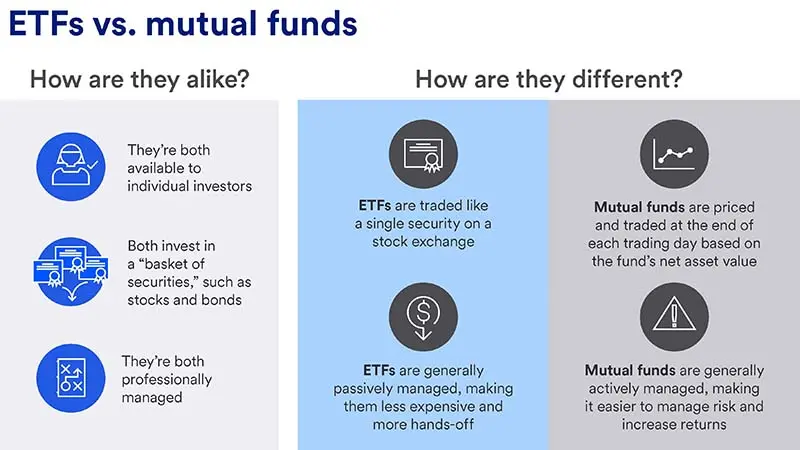

Both ETFs and mutual funds are basically baskets of stocks or bonds, right? Perfect for someone like me who doesn’t wanna pick individual winners—too much stress, and I’d probably mess it up. You get instant diversification without the headache.

The big differences though? They sneak up on your returns in sneaky ways. Like that surprise capital gains tax hit I got from my old mutual fund, even when I hadn’t sold a thing. The manager was churning inside the fund, and boom—tax bill for everyone. ETFs are usually way better at avoiding that crap thanks to their in-kind creation stuff. Investopedia still nails it: ETFs tend to be more tax-efficient, especially the passive ones.

My Personal Beef with Mutual Funds (And the Dumb Mistakes I Made)

Mutual funds aren’t all bad, okay? Some active ones try to beat the market, and if you’re into that gamble, cool. But most don’t beat it long-term, and you pay extra for the attempt.

- Higher fees: Asset-weighted averages for equity mutual funds are around 0.40% these days, per ICI’s latest. My old one was closer to 0.9%—that eats returns big time over years.

- Only end-of-day trading: No reacting to midday news; you’re stuck with whatever NAV hits after close.

- Sometimes loads or minimums: I paid a front-end load once and regretted it instantly, like why did I do that?

I clung to a lagging mutual fund for ages because switching felt like admitting defeat. Lazy me. But index mutual funds can be decent too—Vanguard’s got some with super low costs now.

The Switch to ETFs That Finally Clicked for Me (Total Aha Moment)

ETFs trade like stocks—anytime the market’s open, real prices. Fees are often tiny, like 0.14% average for equity index ETFs (Fidelity data). And that tax edge? Huge for taxable accounts.

My wake-up call was seeing Vanguard’s average index ETF expense ratios down around 0.05% or so. I dumped into VTI and VOO, returns popped (well, relatively), fees vanished, and no random tax surprises.

Contradiction alert: I still hang onto a target-date mutual fund in my 401(k) ’cause the auto-invest and fractional shares are effortless there. ETFs aren’t always perfect everywhere.

ETFs vs Mutual Funds: My Flawed, Real-Life Quick Take

- ETFs usually crush on costs, taxes, and flexibility—check Fidelity’s comparison.

- Mutual funds shine for hands-off auto-dollar-cost-averaging or if you believe in active (spoiler: stats say meh).

- Both have cheap index options now, but ETFs edge it for most of us normals.

I straight-up lost money early by overpaying for active mutual funds. Lesson learned the hard way: Low-cost index ETFs are probably best for like 95% of Americans building wealth slow and steady.

Whew, that’s my unpolished rant on ETFs vs mutual funds—coffee-fueled, a bit rambling, but from the heart. If you’re waffling like I was, just start small: Grab a broad ETF like VTI at Vanguard or Fidelity, set up auto-buys, and chill.

You switched yet? Or still loyal to mutual funds? Hit the comments, tell me your horror stories or wins. And seriously, poke around Vanguard’s ETF vs mutual fund tool—it’s free and might save you bucks.