Living paycheck to paycheck is my reality right now, seriously—I’m sitting here in my tiny apartment in the Midwest on New Year’s Eve 2025, staring at my bank app showing like $23 until Friday, and yeah, that knot in my stomach is all too familiar. I’ve been scraping by like this for years, ever since that layoff back in ’23 hit me hard, and honestly, some months I still panic when the rent’s due. But I’ve figured out some quick money fixes when you’re living paycheck to paycheck that have kept me afloat without totally losing my mind.

My Go-To Quick Money Fixes for Living Paycheck to Paycheck

Look, I wish I could say I have it all figured out, but nah—I’m still very much in the trenches living paycheck to paycheck. Anyway, these are the things that have bailed me out more times than I can count. They’re not glamorous, but they work.

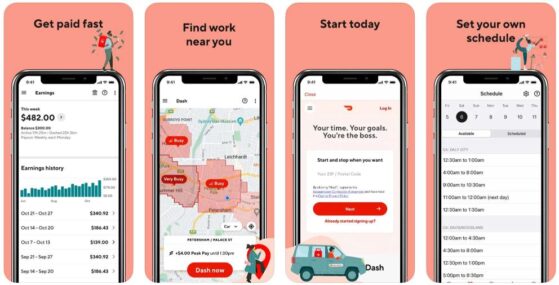

First off, gig apps became my lifeline. Like, last month when my car insurance spiked outta nowhere, I fired up DoorDash and Uber Eats every evening after my day job. I remember this one freezing night in November, dashing around delivering pizzas in the snow—my fingers numb, car smelling like french fries forever—but I pulled in an extra $400 that week. It was exhausting, yeah, but it covered the gap.

A candid, slightly tilted phone screen shot of multiple gig economy apps open at once (DoorDash, Uber, Instacart), with low battery warning and notifications piling up—from my personal late-night hustle sessions, messy and real. Suggest alt text: “Gig apps saving my butt during paycheck to paycheck crunch.”

Selling Stuff You Already Own When Living Paycheck to Paycheck Hits Hard

Oh man, this one’s embarrassing but gold. My closet was bursting with clothes I hadn’t worn since pre-pandemic, so I started listing on Facebook Marketplace and eBay. That old gaming console from college? Sold for $150. Random kitchen gadgets? Another $80. There was this one time I sold my ex’s forgotten hoodie—petty? Maybe, but it paid for groceries.

It’s chaotic, posting pics in bad lighting from my cluttered living room, haggling with strangers… but quick cash, no new debt.

Over-the-shoulder view of someone photographing random household items on a messy bed for online sale, with packing tape and shipping labels scattered—capturing that desperate but determined vibe I know too well. Suggest alt text: “Turning clutter into cash while living paycheck to paycheck.”

Tracking Every Penny to Stretch Living Paycheck to Paycheck Further

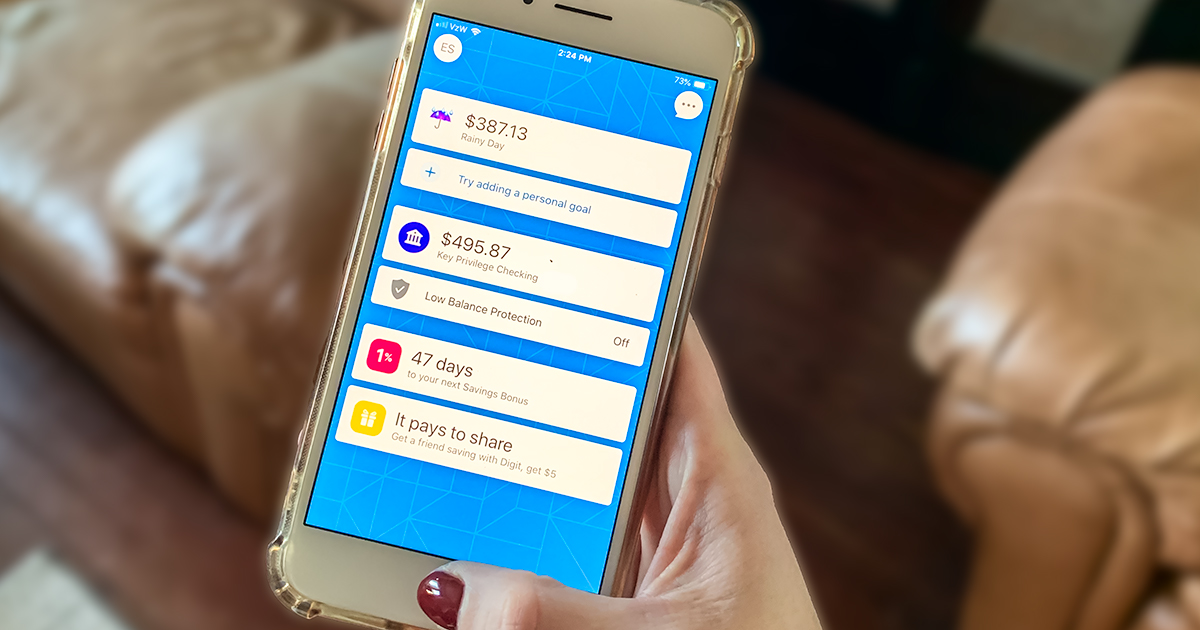

I used to ignore my spending, then wonder where it all went—turns out, coffee runs and impulse Amazon buys were killers. Now I use free budgeting apps religiously. Seeing that low balance stare back at me sucks, but it forces me to cook more (ramen upgrades, anyone?) and skip takeout.

One app I like is Rocket Money—it caught subscription leaks I forgot about, saving me $50/month easy. Check it out here: https://www.rocketmoney.com/learn/personal-finance/living-paycheck-to-paycheck

Close-up of a phone screen showing a budgeting app dashboard with critically low account balance and categorized expenses—from that gut-punch moment we all dread. Suggest alt text: “Budget app reality check for paycheck to paycheck life.”

Little Embarrassing Wins in My Paycheck to Paycheck Journey

Here’s where I get real: I once plasma donated twice a week for quick $100 pops—felt sketchy waiting in that clinic with the vending machine snacks, but it paid my electric bill. And asking for bill extensions? Did that too, negotiating with customer service while hiding in my bathroom so roommates wouldn’t hear. Humbling, for sure.

But these quick money fixes when living paycheck to paycheck add up. I’ve built a tiny emergency fund now—$500, nothing fancy, but it means I’m not totally freaking out anymore.

Wrapping This Ramble on Living Paycheck to Paycheck

Honestly, living paycheck to paycheck still stresses me out daily, especially with prices the way they are in 2025. But mixing side gigs, selling stuff, and brutal tracking has given me breathing room. It’s not perfect—some weeks I slip up big time—but it’s progress.

If you’re in this boat too, start small: download a gig app tonight or list one thing for sale. You’ve got this, seriously. Hit me in the comments with what works for you—let’s chat like real humans figuring this mess out together.