Sitting here in my cramped apartment, December 31, 2025, fireworks probably gonna start soon outside but it’s just that dull slushy snow piling up on the window sill, my coffee’s cold again, and I’m scrolling through my bank app thinking, damn, I actually did wealth up my finances a bit without some six-figure job. Not rich, but I’ve got a little buffer now, some investments growing slowly. It’s messy, I backslide sometimes—like that dumb takeout spree last month—but yeah, progress.

Why Wealth Up Finances Felt Impossible at First (And Still Does Some Days)

Man, a few years back I was straight-up broke. Salary stagnant, inflation kicking my ass, and I had this habit of “treating myself” to stuff I couldn’t afford. Remember that time I racked up $5k in credit card debt just from random Amazon buys and bar tabs? Embarrassing as hell, I avoided calls from collectors for weeks. Everyone online was posting about their “wealth building journeys” with high-paying remote jobs, and I’m over here in Ohio wondering if I can skip groceries to make rent. That low point? It forced me to get serious about wealthing up my finances, no excuses.

The Budget Hacks That Actually Helped Me Wealth Up Finances

First real step: tracking every penny like a hawk. I started with a free app, then just Excel because I like messing with spreadsheets (nerdy, I know). Cut the fat—canceled subscriptions, said no to daily coffee runs (mostly). I kinda follow the 50/30/20 budgeting rule but tweaked it when life got real, like 60% on necessities some months. It sucked at first, felt deprived, but after a while that saved money started piling up for debt payoff. Pro tip from my screw-ups: automate transfers to savings the day payday hits, before you can spend it.

My chaotic budget desk sessions] Image Details: Low-angle personal view of a cluttered desk drowning in receipts, stained coffee mug, calculator mid-calculation, and laptop glowing with budget sheets—capturing that raw moment of wealthing up finances amid the mess.

Side Hustles I Tried to Wealth Up Finances (Some Worked, Some Flopped)

No high salary boost coming, so side gigs it was. Sold junk on Facebook Marketplace—made $400 once from old electronics gathering dust. Then freelance stuff online, inconsistent as hell, but extra $300-600 some months went straight to building wealth. Burnout was real though, late nights after work, eyes burning. One flop: tried dropshipping, lost a couple hundred before quitting. Better bet? Check Ramsey’s side hustle ideas for starters. Mine weren’t sexy, but they helped wealth up my finances without totally destroying my sanity (okay, almost).

Grinding those late-night side hustles] Image Details: Over-the-shoulder or cozy apartment view of someone (me) hunched over a laptop, tired eyes, warm lamp light, apps open— that determined grind to wealth up finances extra cash.

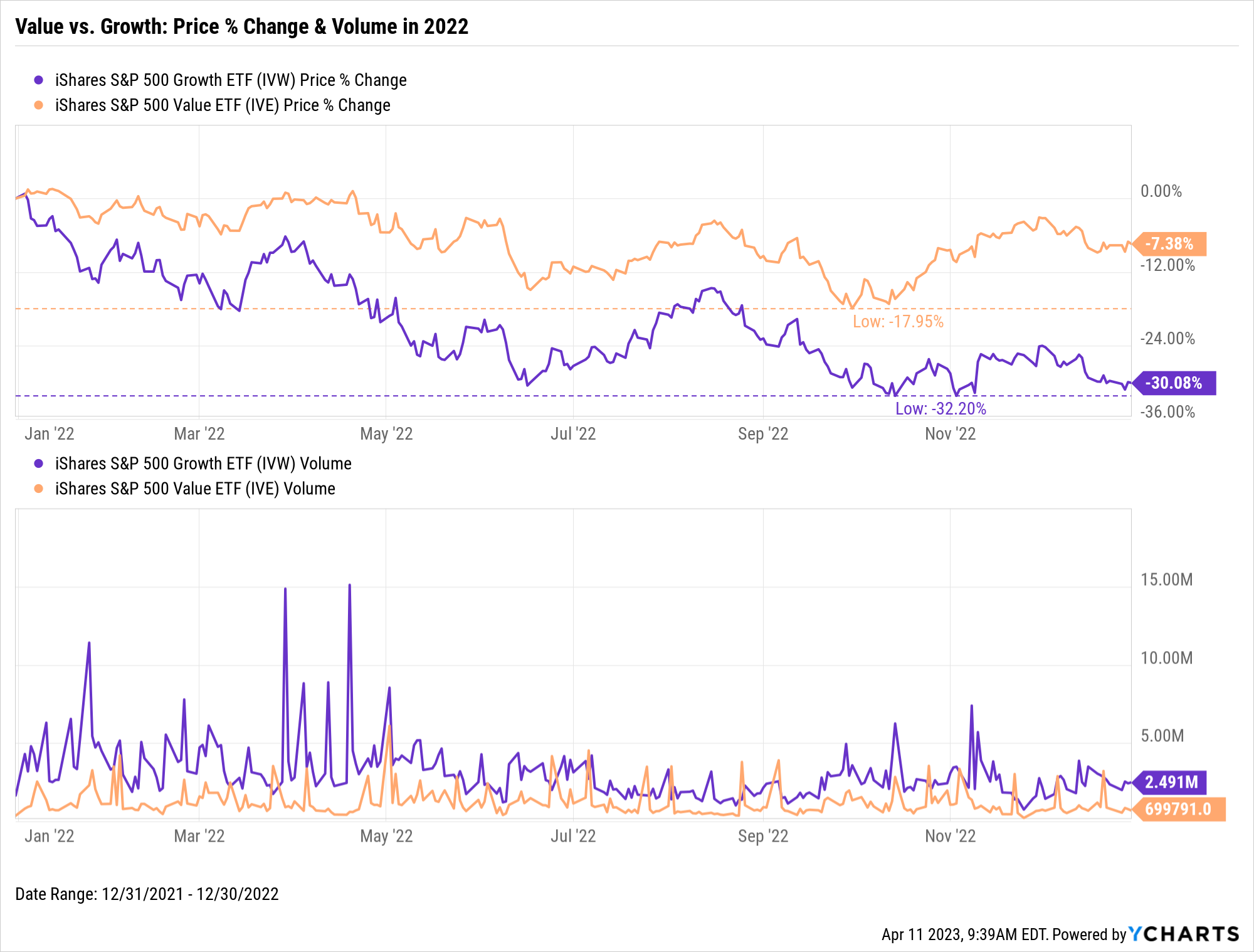

How Investing on a Low Income Started to Wealth Up My Finances

Thought stocks were for Wall Street bros? Nah. Opened a Roth IRA with Fidelity (Vanguard works too, low fees). Dump small amounts into index funds tracking the market. Read up on basic investing principles. Mistake I made: sold during a crash once, lost out on rebound. Now I just hold, let it compound. Even $100/month adds up over years— that’s the magic for us regular folks wealthing up finances slow and steady.

Seeing that sweet growth] Image Details: Close personal perspective on a phone screen held in hand, showing an upward-trending investment chart— the quiet win of low-income investing to wealth up finances.

Anyway, wealth up your finances isn’t glamorous, it’s a grind with plenty of “why did I do that” moments—like my recent impulse buy relapse. But if I can do it on a meh salary in the US, scraping by sometimes, you probably can too. Flawed as hell here, but honest.

What’s your biggest hurdle right now in trying to wealth up finances? Or one win you’ve had? Share below, or just pick one thing—like tracking expenses for a week—and start. Here’s to 2026 being less broke. Cheers.