Cash flow vs profit is something I totally butchered for way too long, like seriously, it almost wrecked my whole side gig back in the day. I’m sitting here in my crappy home office in suburban Texas right now—it’s New Year’s Eve 2025, fireworks popping outside already, empty coffee mug with that stale burnt smell lingering, and I’m staring at my bank app feeling that old knot in my stomach again. Anyway, cash flow vs profit hits different when you’re an American hustling through inflation and whatever fresh hell the economy’s throwing this year.

I thought being profitable meant I was killing it. Nope. Profit is that number on your income statement after all the revenues minus expenses—it’s like the score at the end of the game. But cash flow? That’s the actual money moving in and out of your accounts right now, the stuff you use to pay rent, suppliers, or that unexpected vet bill for your dog. I learned this the hard way when my freelance design thing was showing “profits” but I couldn’t even cover payroll for myself some months.

Why Cash Flow Vs Profit Trips Up So Many People (Including My Dumb Ass)

Look, most folks—including me back then—mix up cash flow vs profit because profit includes stuff that isn’t cash yet. Like, you invoice a client for $10k, boom, that’s revenue, subtract costs, profit looks great. But if they pay in 90 days? You’re profitable on paper but eating ramen in reality. I had this one big client who always paid late, and I was too scared to chase them ’cause, you know, imposter syndrome or whatever. Embarrassing as hell now.

Debunking the Myth: Don’t Panic-Sell When a Recession Is Predicted

Here’s the raw deal:

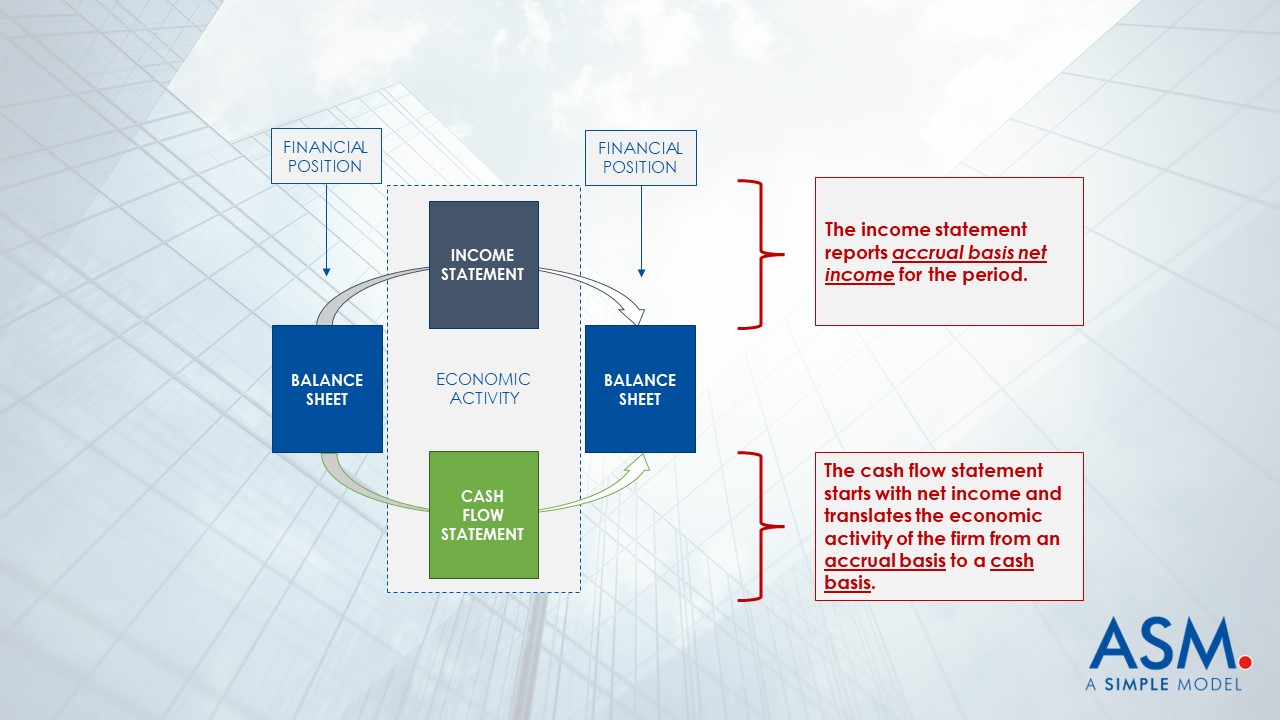

- Profit = Revenues – Expenses (accrual accounting magic, includes non-cash stuff like depreciation)

- Cash flow = Actual cash in minus cash out (operating, investing, financing activities)

Investopedia nails it: profit is long-term success, but cash flow keeps the lights on short-term. And yeah, businesses can be profitable and still fail—82% of failures tie back to cash flow issues, not lack of profit.

My Personal Cash Flow Vs Profit Nightmare Story

Okay, full honesty mode—back in 2022, I had this e-commerce side hustle selling custom tees. On the books? Profitable as hell, like $50k net profit that year. Felt like a boss. But cash flow? Disaster. I fronted inventory for big orders, customers paid on Net-30, suppliers wanted cash upfront. One month I was staring at a $8k profit but only $200 in the business account. Had to dip into personal savings, max a credit card—felt like such a failure, man. Sitting in my garage “office” sweating bullets, dog whining ’cause I forgot dinner. Contradictory as it sounds, I was “successful” but broke.

Then I read this Forbes piece on how profit doesn’t equal survival, and it clicked. Cash flow vs profit isn’t interchangeable; ignoring cash flow is like winning the lottery but the check bounces.

Three Financial Statements | A Simple Model

How to Not Screw Up Cash Flow Vs Profit Like I Did

Tips from my flawed trial-and-error:

- Track both obsessively. I use QuickBooks now—cash flow forecast saved me.

- Get paid faster: Deposits, shorter terms, invoice immediately.

- Delay outflows where you can—negotiate with suppliers.

- Build a buffer: Aim for 3-6 months expenses in cash.

Seriously, cash flow is king for survival; profit is queen for growth. Don’t be like me and learn late.

1+ Thousand View Cluttered Desk Royalty-Free Images, Stock Photos …

Anyway, that’s my unfiltered take on cash flow vs profit. If you’re nodding along or cringing at your own stories, hit up your numbers today—maybe sketch a quick cash flow projection while the ball drops tonight. What’s your biggest cash flow horror story? Drop it below, let’s chat. Happy New Year, y’all—here’s to actual money in the bank in 2026.