Cash flow management 2025 has been my obsession this year, seriously—sitting here in my Brooklyn apartment on December 31st, fireworks popping outside already, cold coffee gone stale on the desk, and I’m reflecting on how the rich keep money moving like it’s alive. Not hoarding it in some sad savings account earning peanuts. Me? I’ve been the queen of letting cash sit and rot for years, but nah, not anymore.

My Dumbest Cash Flow Management Mistake Ever

God, where do I start? Back in 2023, I had like $35k parked in a checking account basically earning zilch while I was drowning in high-interest debt from a dumb side hustle flop (crypto gadgets, what was I thinking?). Felt so safe having that “buffer.” Meanwhile, folks with real wealth were leveraging low-rate loans to scoop up assets. When it hit me, I legit facepalmed so hard. My money had zero velocity, zero cash flow management sense. Embarrassing as hell.

Velocity of Money – The Rich Person Superpower in 2025

Okay, velocity of money? That’s the secret sauce. The rich treat dollars like they gotta circulate fast to breed more dollars. My friend who’s low-key loaded explained it: cash hits the account, immediately gets deployed—into deals, paying down smart debt, whatever keeps the cycle going. I checked the latest data from the St. Louis Fed, and M2 velocity is still crawling around 1.39 as of mid-2025 (check it here: https://fred.stlouisfed.org/series/M2V). Most of us regular Americans are part of that slow grind, money just sitting. But the wealthy? They’re cranking personal velocity way higher.

How the Rich Actually Structure Cash Flow in 2025

From what I’ve seen (and awkwardly grilled richer friends about):

- Real estate loops: Still huge—BRRRR method, but smarter with depreciation bonuses keeping taxes low while positive cash flow rolls in.

- Borrowing against assets: Policy loans or HELOCs at low rates to fund the next thing without selling.

- 0% intro cards and lines of credit: Churning those promo periods like pros. I did it this year with a card offering 18-21 months 0% (deals are still out there, like Wells Fargo or Chase options—rates updated late 2025).

Kiyosaki’s Cashflow Quadrant still slaps for this mindset shift (timeless read: https://www.richdad.com/). Moving from employee grind to building systems where money flows on autopilot.

What My Cash Flow Management Looks Like Now (It’s Messy)

I’m no millionaire yet, but here’s my chaotic 2025 setup:

- Freelance gigs → high-yield savings (around 4.2% these days, per Bankrate updates) → every couple months → payoff promo card or into rental fund

- That one rental pulling slim $200/month positive cash flow (better than negative!)

- Roth and solo 401(k) for tax perks, plus borrowing options if needed

- Keeping credit utilization low for the score, churning a 0% card carefully

High-yield rates dipped a bit to top out around 4.17-4.20% end of year (Forbes/Bankrate tracking), but still beats nothing.

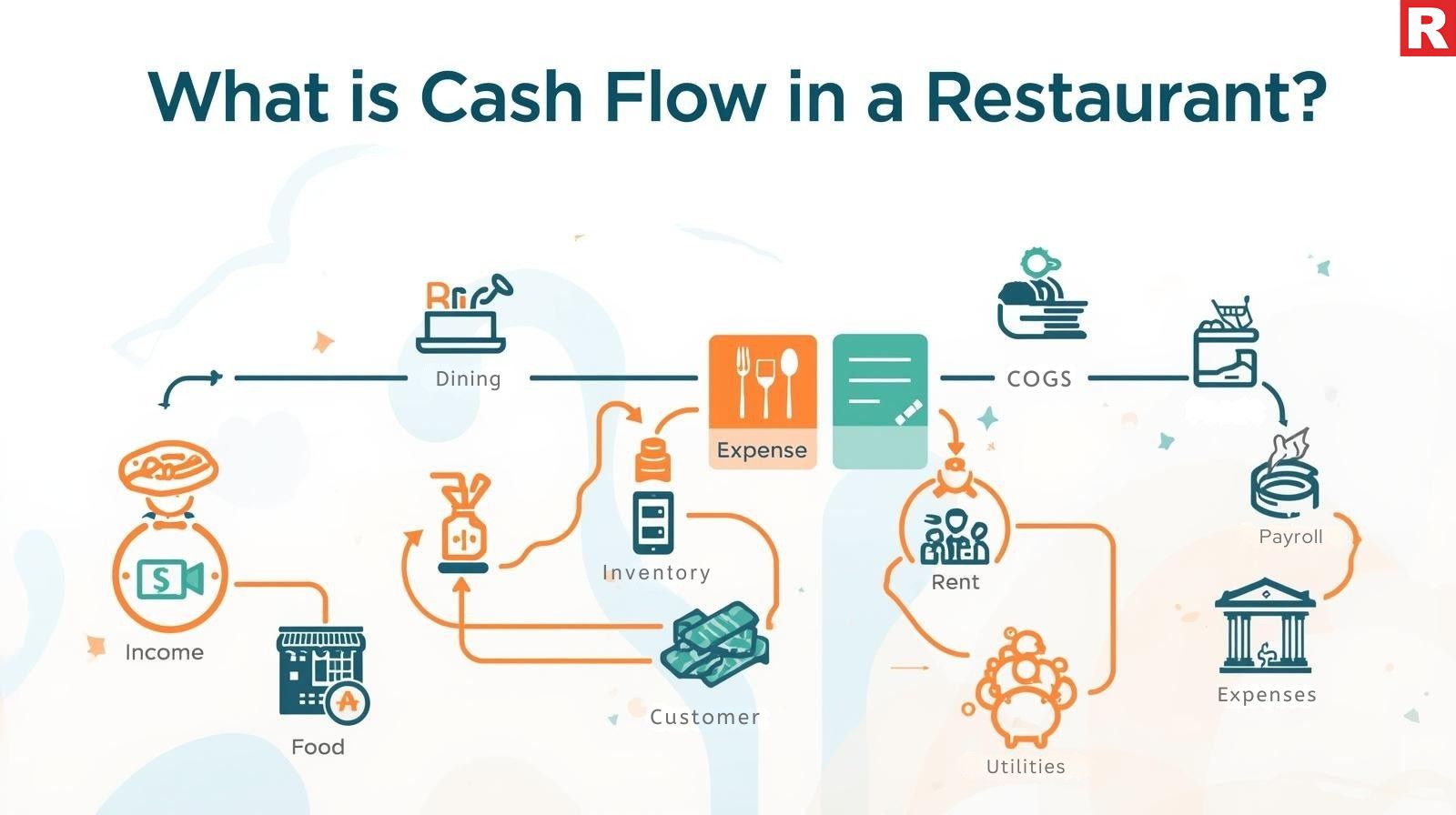

Managing Your Restaurant’s Cash Flow Like a Pro – Restaurant India

Some months I’m sweating bills, contradictions everywhere—I preach velocity but still impulse-buy takeout. Human, right?

Final Thoughts on Cash Flow Management 2025 – From a Very Average American

Cash flow management 2025 taught me it’s not about stacking cash, it’s about momentum. The rich keep money moving, building compound wins. I’m flawed, still learning, but way better than before.

Start where you are—track your flows for a month, move one stagnant pile. Your future self will thank you.

Happy New Year, fr. What’s your big cash flow move for 2026? Hit the comments, I swear I read ’em all.